24 July 2023

The big importance of Australia’s smallest businesses

It’s the fastest growing sector of the small business community and employs nearly three million Australians, but how many of us actually know what a microbusiness is?

Relatively unknown, and often overlooked, the microbusiness sector doesn’t get the attention it deserves when it comes to small business and economic policy in Australia.

Hopefully, that’s about to change.

To better understand what our microbusiness sector looks like, NRMA Insurance has commissioned The McKell Institute to produce the ‘Micro but Mighty: Magnifying microbusiness in Australia’ report. Released today, the report takes a comprehensive look at the sector, exploring the challenges faced by microbusiness owners and the policies needed to overcome them.

Defining microbusiness in Australia

Let’s start with a look at what a typical microbusiness looks like.

Defined by the Australian Bureau of Statistics (ABS) as a business with between 0-4 employees, microbusinesses make up 89 percent of all businesses in Australia.

They’re less formal in their operation, and might not have a conventional office, shopfront or warehouse. Many microbusiness owners are self-employed and have simple financial structures with cash-flow constraints. Because of their size, microbusinesses have close connections with their customers and the community they operate in.

Sounding familiar? You might be a microbusiness owner yourself, or work for one. If not, you most likely know one through family or friends.

The thing is, microbusinesses make a significant contribution to the Australian economy.

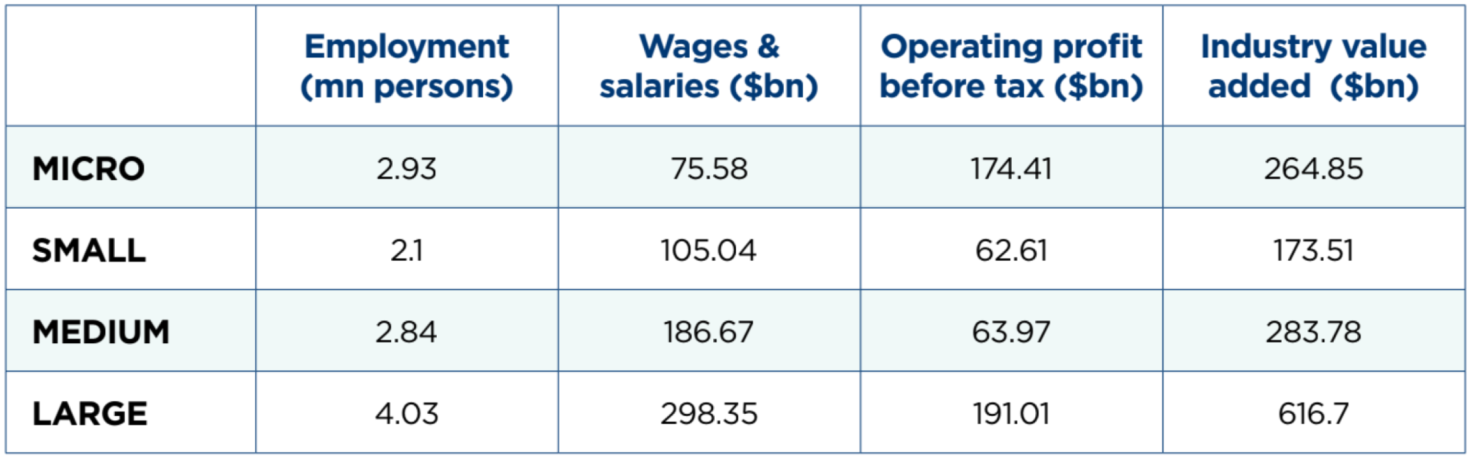

Currently, they’re classified under the small business umbrella. The data shows, however, that if they were treated as a separate category, they contribute more employment, profit and value added than other small businesses.

So why the need for the ‘Micro but Mighty’ report? For NRMA Insurance, which helps more than 70,000 small business owners across the nation, including many microbusiness owners, it’s about support.

“There are incredible opportunities for this sector,” NRMA Insurance Chief Executive Officer Julie Batch says.

“Not only in economic contribution to the nation, but also the positive impacts many of these businesses have within their local communities.”

A closer look at women in the sector

The report also found that 35% of all businesses in Australia are owned by women, and that number continues to grow.

Many of those businesses are microbusinesses. With greater flexibility and lower barriers to entry than traditional employment, it’s often the perfect fit.

With women an increasingly key player in the sector, the report also takes an in-depth look at NRMA Insurance partner Mums & Co, a nationwide network of mothers who run their own businesses.

The McKell Institute heard from a range of Mums & Co members, who spoke about the ups and downs of being microbusiness-owning mums.

Elle Sitek, founder, owner and sole worker at Single Mama Way counselling service, talked about how being a business owner allows her to better manage her work/life balance while still supporting her community.

“The flexibility of working hours has been paramount in creating this business and contributing to society,” she said.

“In addition, the freedom of autonomy and satisfaction that the buck stops with me motivates me to reach out and create something that serves my local community.”Elle’s desire to use her business to help others was a common thread in the ‘Micro but Mighty’ case studies. It shows how microbusinesses not only serve their owners but also the communities that they operate in.

The challenges microbusinesses face

With a stronger reliance on e-commerce than small, medium and large businesses, technology poses both an opportunity and a threat for microbusinesses. 41% of microbusinesses make the majority of their sales on the internet, which can present cybersecurity issues. Microbusinesses can be ill-equipped to deal with such threats, given their limited resources.

Elle, who provides her counselling service through virtual face-to-face sessions and stores sensitive client data sees this as a key concern. However, she also reports that the information shared via the Australian Small Business Advisory Services has been very helpful.

The ‘Micro but Mighty’ report also found that climate change and extreme weather events are another key issue. While climate change can impact businesses of all sizes, microbusinesses are particularly vulnerable, with lower levels of capital and liquidity making it difficult to defend against disaster-related losses.

In 2020, one in six microbusinesses said environmental factors were a barrier to business activities - a number that had nearly quadrupled from the same ABS survey two years earlier.In addition, there are other challenges that affect the success of microbusinesses in Australia. A lack of access to specialist teams and knowledge in areas such as finance and marketing can be an obstacle to growing the business.

The way forward

It’s clear that more attention needs to be provided to the microbusiness sector. The report provides five key recommendations to be considered by all levels of government in Australia:

- Establish a formal definition of microbusiness in Australia: Including a measure of turnover, or the value of assets, would ensure that only truly ‘micro’ businesses are being measured by official statistics and targeted by government policy.

-

Create a one-stop-shop resource for microbusiness support and resources across all levels of government: While there’s already a range of grants, training and other resources available for microbusinesses, these forms of support are fragmented and sometimes difficult to access. Bringing them all one platform would ensure that support is available to those who need it most.

-

Provide government support that treats microbusiness as a separate category from small business: If microbusinesses were categorised separately to small business, so too could the government resources available to them. Information and training related to cybersecurity, for example, could focus on the online-dependent nature of microbusinesses income, while grants could look to address key commercial barriers like marketing.

-

Address the structural barriers that limit access to finance for women who own businesses: Gender shouldn’t play any part in a business owner’s ability to secure funding, however there is a current imbalance when it comes to who receives business loans. Policies and initiatives aimed at improving gender-based lending practices could go a long way to support women-owned microbusinesses.

-

Partner with the financial sector to provide education courses for microbusinesses that will help them grow: With more financial information, microbusiness owners would be able to navigate one of the main barriers to success. It would be a mutually beneficial arrangement - a financially savvy microbusiness sector would provide more business opportunities for the banks.

By partnering with Mums & Co, NRMA Insurance hopes to tangibly support the growing number of business-owning mums across the country. NRMA Insurance knows the importance of the microbusiness sector and will continue to advocate for the millions of Australians who are owner/operator/everything of their business.

Mums & Co support and advocate for women and their supporters in small business, helping to build deep networks, and provide strategic guidance and expert resources. They are a digital community plus a point of real-life connection for like-minded women attending their live events. www.mumsandco.com.au

To help protect your business, no matter the size, visit NRMA Insurance for a business insurance quote.

Always read the PDS & TMDs from NRMA Insurance.